"Age of Insecurity" - tariffs, realignment, 'slowbalization'

In a week that's felt like a year, a zoomed-out look at the tariffs' impact on retailers' thinking; Tsonduku section; recent activities... all in no particular order.

The Most Beautiful Word

Tariffs. As I hit send, US Customs are about to collect tariffs from 86 countries with levels from 11~50%1. Kier Starmer, the UK’s prime minister, announced the ‘age of uncertainty’ as he detailed the government support for the UK’s car and pharmaceutical industries in the face of US President Trump’s blitz of global trade tariffs. In a week that has seen penguins and uninhabited islands targeted, cod-economic formulae ascribed to ChatGPT, and coining the term “Panicans” there has been much gallows humour on social media. But the chilling impact of the tariffs has been written in red on every major stock exchange and in the brows of Europe’s retailers and brands, with JP Morgan predicting ‘there will be blood’. Meanwhile retailers and brands are checking their export systems, polishing their HTSUS2 categorisations, making sure that their electronic reporting connections are up to speed, and considering the post-tariff price in the US.

The biggest big questions at the moment are:

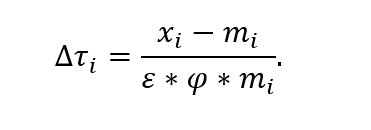

what will the landed price in the US be? Even for an established business with optimised customs processes, the tariffs will need to be reworked for elements from countries now targeted. Here’s the BBC’s helpful worked example for a Nike running shoe made in Vietnam. Many products are more complex.

Source: BBC how will this compare with the also-being-recalculated-as-we-speak price of competitor products and alternatives? Our suppliers and sources, manufacturing partners or finishers may themselves be subject to (new/changed) tariffs and so that will impact their costs. Every competitor’s costs, at the individual product level, will be changing.

who will bear the increased cost - me, my wholesaler, the consumer, all of us?

reworking my (re)supply approach to manage cashflow. Tariffs are payable on landed goods, in full, with no rebate for goods returned or unsold. This creates an immediate ‘hit’ of 10% on the cost of goods sent to the US. This has a cashflow impact (money up-front, in advance of sales revenue), and an increase in the sunk cost on unsold inventory.

how to re-tool my supply chain, my own sourcing, manufacture and design in order to insulate myself in the medium term from both the current impact of tariffs and any future capricious flexing of rates and scope.

After decades of continuous harmonisation, optimisation and systems improvement, tariffs have not been a board-level discussion since the UK’s Brexit (when the General Agreement on Tariffs and Trade became a dinner conversation). We will now become fluent in the arcane categorisation of the “Dictionary of Everything a Consumer Can Buy”3, and electronic product data AES and submission and look at the EU’s Digital Product Passport’s4 origin and materials requirements as helpful preparedness!

Elephants fight

Leaving aside the short-terms shocks to the markets, recent escalation indicates that this is a grudge-match between the US and China. China’s president Xi has called the tariffs “blackmail” and Trump’s additional tariffs-upon-tariffs as a “mistake upon mistake”5. Meanwhile a state-endorsed news outlet called the tariffs “naked extortion”. Neither Trump nor Xi are temperamentally inclined to back down and with Xi publicly vowing to “fight to the end” then the more consequential relignment on trade will be into the US-bloc and the China-bloc. There are a number of ramifications, but with China extending its influence in LatAm and Africa, touting itself as a trustworthy, stable commercial partner to Europe, and a powerbroker-in-waiting in the Middle East, this plays into Xi’s hands by creating a de-facto “bi-polar” world of US versus China, rather than the global hegemony of the US as the military-tech-consumer-cultural unassailed leader of the turn of the century. Vietnam - penalised with 46% tariff levels, after warm relations with President Biden - finds itself between an unreliable USA and a belligerent but consistent Beijing. President Xi’s planned tour later this month to Vietnam, Malaysia and Cambodia is well-timed to capitalise upon the shifting alliances.

Within the US there are dissenting voices (Musk, Ackman, Koch) but Trump has doubled-down with 104% tariffs on China and claims that $2bn a day is being raised.

So how did we get here…?

Towards tariffs

The tariffs have been long trailed by President Trump. They signal a shift from the US’s use of trade to influence and control the world and their own citizen’s prosperity to a more isolationist, punitive view in which tariffs are used to threaten and punish trading partners. The aims of the policy seem to be:

to bring partners to a negotiating table in a weakened position, ready to pay the US for the ability to trade, especially those who are deemed to have ‘exploited’ the US’s goodwill

to raise revenues that can be used as a basis to reduce income tax (long an objective of his, started with the 2017 Tax Cuts and Jobs Act), with a promised extension to the TCJA (costed at $4trillion by CNN, along with an additional $3.3trn of other tax cuts).6 Trump’s intention seems to be to return the US to its pre income tax days when the (slimmed down?) federal government was funded by tariffs

to repatriate employment to the US.

The end of globalisation?

Globalisation - the process by which the world became increasingly interconnected through the exchange of goods, services, capital, information, ideas, and cultural practices across national borders - has been under threat since the 2008 financial crisis. The crisis shows that vulnerabilities could also cross national borders and that this contagion, allied to a reduced trust in governments, led to calls for protectionism and what the Economist termed “slowbalization”. The comfort of a pun in troubling times!

After bank bailouts were seen as helping the rich at the expense of the poor(er), the focus turned to the unequal dividend of globalisation. It could be argued that the movement of the benefits from labour to capital (i.e., from the in-country working citizens to the owners of mercurial, border-defying, and lightly-taxed capital) fed into the phenomena of Brexit and Trump’s first presidency.

The distribution of benefit from 2017 is shown below, and the current Administration’s plans are set to accentuate the disparity.

Contextual thinking, in no particular order

Tariffs have unleashed implications that will resonate across all areas of business, politics and society. Some thoughts and questions below.

Goods only. Trump’s tariffs are focused on physical goods and largely ignore intangible services and intellectual trade. The non-physical aspects of globalisation (sometimes called the ‘pillars of globalisation’) are also changing. The five pillars are held to be trade, capital flow, migration, information transfer, and cultural integration. Capital flows are uniterruped (despite sanctions) and we’ve seen money move around the world, across instruments, seeking safety and profit. Migration of people shows little abatement, legal or otherwise, and the result of tariffs has affected the movement of talent. Germany is actively and publicly offering US scientists ‘sanctuary’ here and here. Information transfer, data and AI span the globe in milliseconds, and the US administration’s “war on woke” can be seen as another attack on globalisation, even as cities become more cosmopolitan (global, integrated, liberal).

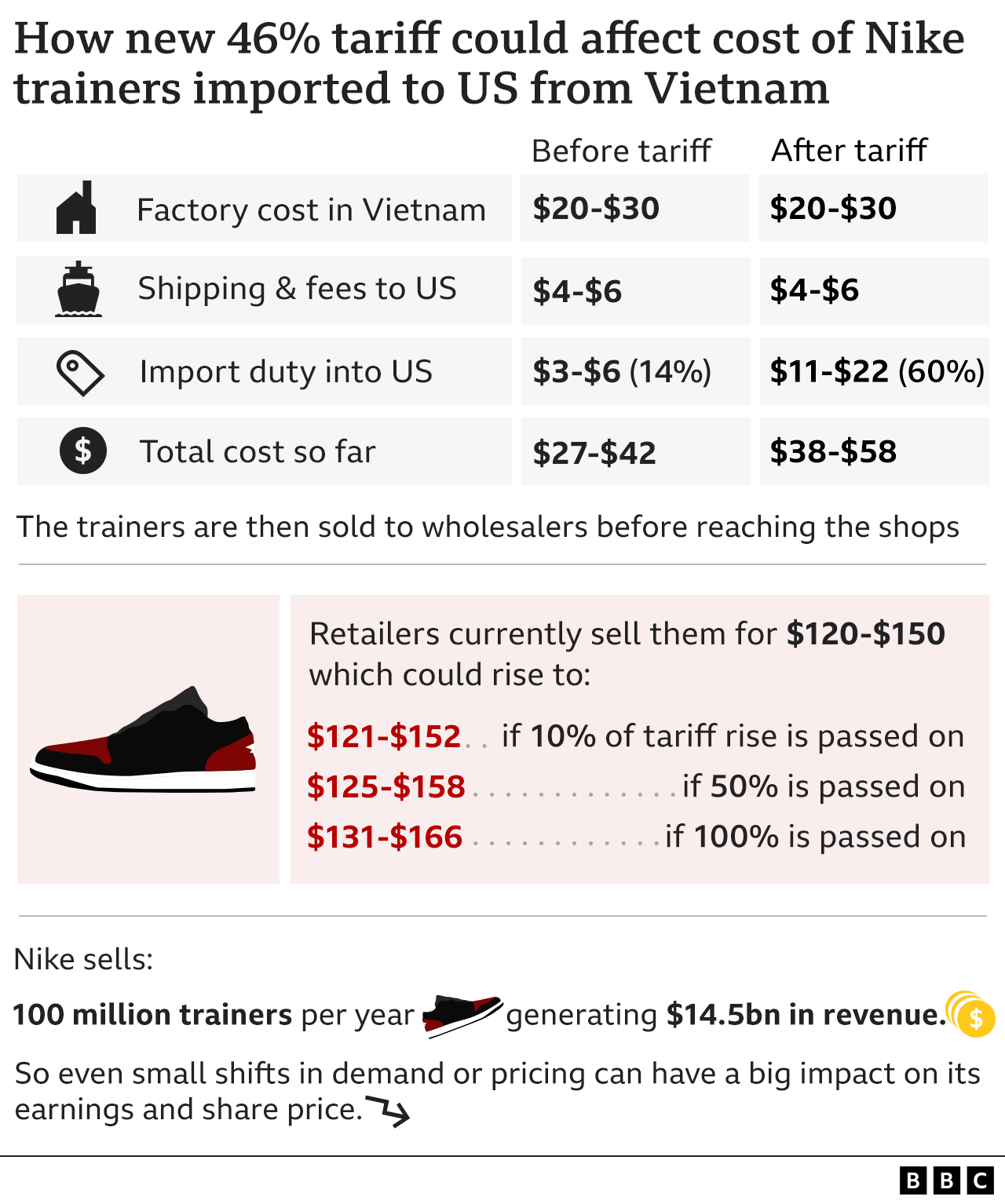

Open and closed markets. The US is a relatively closed market in which trade (goods and services) comprises around a quarter of its GDP. Looking solely at physical goods, the US imports 18% of global exports (while its own exports comprise 14% of the world total). This might imply that the US consumer will not suffer too greatly from tariffs, however this number doesn’t include all of the supply chain and ‘transformations’ that occur even in US-made goods. Meanwhile, China has been growing its internal consumption as it pivots from a cheap-labour factory-for-the-world. Its GDP is now only 37% based on trade (down from 65% in the 2000s7. China will seek to consume more of its own produce while increasing export to non-US markets.

Source: Eurostat Dumping. There is a fear of “dumping” goods at reduced prices into mature markets (eg cheap electronics or coffee machines that were destined for the US undermining manufacturers in the UK or Europe), yet at the same time a desire for cheaper raw materials that can be ‘transformed’ within a high-value, high-skills economy (eg the UK hoping for cheaper steel, oil, some food products). This duality - wanting cheap inputs, while preserving the spending power for one’s own exchequer - is a microcosm of the Trump trade tariff approach.

Where is value added to raw materials? Non-transformed goods will suffer most. If a UK fashion brand simply buys Chinese silk that is sewn in Vietnam and sent direct to US consumers, then the products will attract the full tariff levels since the product is “from” those countries. It has not been “substantially transformed”. Where raw materials are turned into a higher-value product in the UK, say, then those products will be deemed to originate here and so attract the 10% tariff (at the time of writing). Brands will therefore push the ‘value-adding transformations’ to low-tariff regions, however this may not be the US.

Presidential powers. President Trump has extensive tariff-setting powers that are unusual in a democracy, especially one that has long held to a legal and treaty-based approach to trade. President Trump leveraged the International Emergency Economic Powers Act (IEEPA) declaring a national emergency based on persistent U.S. trade deficits and nonreciprocal trade practices8. This unprecedented use of IEEPA allowed him to bypass traditional congressional procedures and implement a baseline 10% tariff globally, with higher rates targeting specific countries9. While the Constitution assigns Congress the power to regulate commerce and levy taxes, Congress has delegated substantial trade authority to the president through various statutes, and so protracted legal arbitration is to be expected as Congress signals unease at the unilateral actions10.

Where next?

The last fortnight has been a slow ‘bang’ of the starting gun. The daily shifts and shimmies, with megaphone diplomacy and ideas tested in tweets has caused a lot of uncertainly and broken long-held confidences. However, as the tariffs come into play the landscape splits into:

the 10% club. Mostly keeping quite, not drawing fire, looking to absorb the pressure and biding their time

the supplicant countries, the 70 queuing for a call with the White House, offering up deals, tribute and concessions, looking to get favoured treatment

some belligerent and strident countries (Canada the brave, with attack billboards)

… and China!

That’s the long view of tariffs, the context and responses. In future editions I’ll look at other areas - let me know of your experiences, insights and questions.

Tsonduku

Tsundoku (積ん読) is the phenomenon of acquiring reading materials but letting them pile up in one's home without reading them. i-d Magazine returns to the physical news stands - ‘tangible and collectible’ - as luxury meets analogue nostalgia and the rarity of the real object.

“The Bells of Old Tokyo” - a written audioguide. “Anna Sherman tells of her search for the bells of Edo, exploring the city of Tokyo and its inhabitants and the individual and particular relationship of Japanese culture - and the Japanese language - to time, tradition, memory, impermanence and history”. For a more digital view on time in Japan, and the 5pm “goji no chaimu” this site will answer questions you didn’t know you had.

More reading to come - what’s on your reading list awaiting attention?

Departmental updates

Tannoy announcements🥛 From the dairy department, the Danish word “Tandsmør”, where there's so much butter on bread that your teeth leave indentations when you bite into it [insta]

📹 From the security team, also known as the Minority Report Department, we hear that “The UK government is developing a “murder prediction” programme which it hopes can use personal data of those known to the authorities to identify the people most likely to become killers.” Nothing to go wrong here.

🤥 From the Marketing department, why perhaps you shouldn’t be yourself - “4 reasons why authenticity is overrated”. I really, really mean this.

Endmatter

Thanks for reading. Let me know any feedback, suggestions for topics or even contributions. In between newsletters there is Linkedin and Instagram, and of course the RetailCraft podcast and RetailX analysis.

A la prochaine.

Enjoy the footnotes…

See CBP’s official announcement here: https://www.cbp.gov/newsroom/announcements/official-cbp-statement-liberation-day-0

The Harmonisted Tariff System for the US (HTSUS) can be seen here: https://hts.usitc.gov/ It’s a non-trivial endeavour to read and understand it. Indeed the Customs and Border Protection’s own guide to consumers in the US notes drily: “The Harmonized Tariff Schedule of the United States (HTSUS) lists classification numbers for every conceivable item under the Sun. The HTSUS is the size of an unabridged dictionary, and specialists train for months to learn how to correctly classify goods” (https://www.cbp.gov/trade/basic-import-export/internet-purchases)

The much-loved “Schedule B” lists every product subject to customs assessment in great detail. You can enjoy the schedule online (https://www.census.gov/foreign-trade/schedules/b/2025/index.html) but this entry gives a flavour of the categorisation detail:

6403.51.1100- - - - Footwear made on a base or platform of wood, not having an inner sole or a protective metal toe-cap (Prs.)Press release and the full Eco-Design legislation.

Source: The Guardian

“Trump’s extensive tax wish list is very pricey and comes at a time when the nation’s debt is rising swiftly. Extending the 2017 Tax Cuts and Jobs Act could cost more than $4 trillion, and the incoming president has promised more than $3.3 trillion in tax relief measures on top of that” Source.

See https://peacediplomacy.org/2025/03/18/chinas-strategic-preparedness-for-a-new-round-of-trade-war-with-the-u-s-a-comparative-analysis/ for figures and analysis.

Reference: Wilmerhale

Trump's tariff actions may face legal challenges under the Supreme Court's "major questions doctrine." This judicial principle holds that when executive actions address issues of "vast economic and political significance," they require clear congressional authorization. [WSJ]

The Biden administration faced similar challenges when the Supreme Court invalidated its student loan forgiveness program in Nebraska v. Biden (2023), despite statutory language that appeared to grant broad authority to the Education Secretary. Trump's tariffs, which could cost American consumers hundreds of billions of dollars, might similarly be viewed as having "staggering" economic significance that requires more explicit congressional approval [Vox].